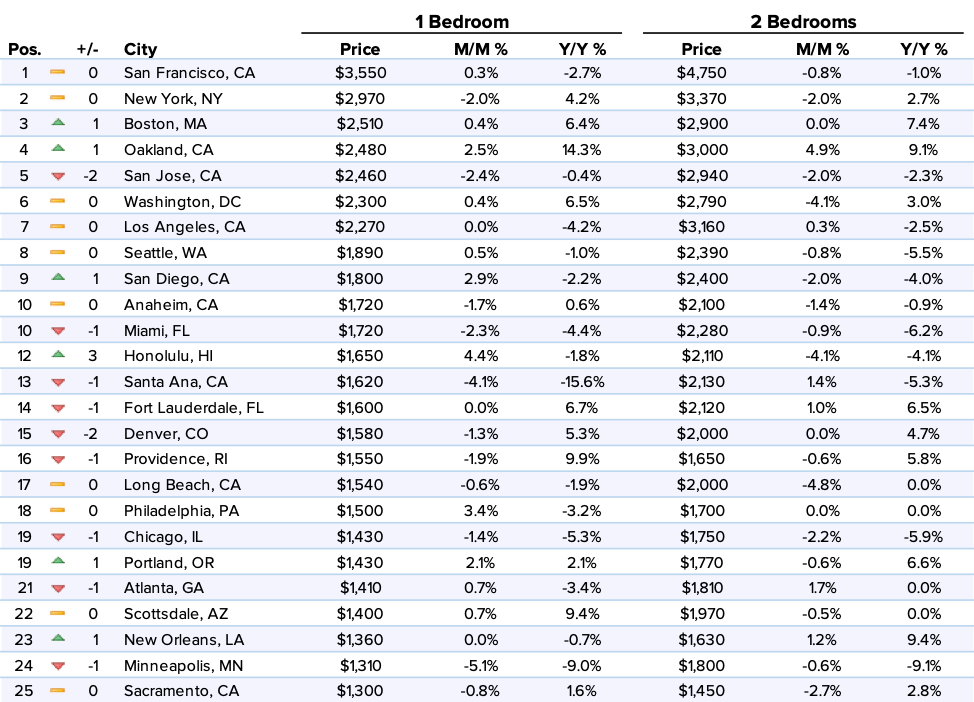

In the top markets, San Francisco one bedroom rent stayed relatively flat last month at $3,550 while New York City continued its downward trend, falling to $2,970. Boston and Oakland both moved up one spot, to rank as 3rd and 4th, respectively, and pushed San Jose down to 5th. The cities in the top 10 remained unchanged though there was movement amongst themselves.

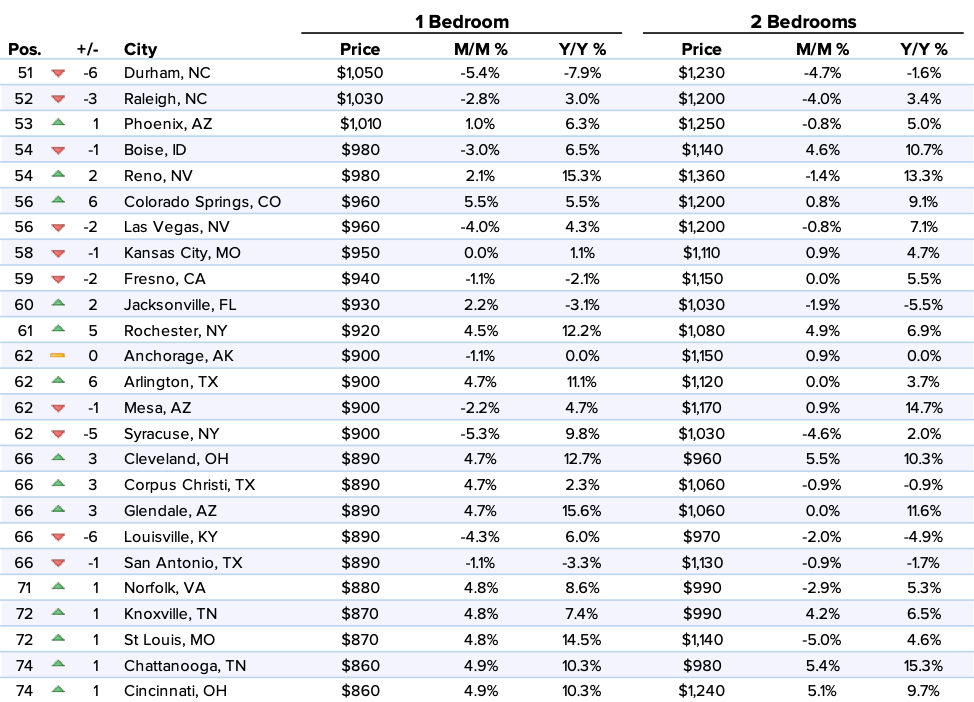

The rest of the nation saw more volatile changes, especially in the lower 50 markets, in both monthly and year over year terms. While Lincoln one bedroom rent had the largest monthly growth rate, up 5.7%, Durham saw the biggest rent dip, down 5.4%.

Overall, the median one bedroom rent fell 0.7% to $1,241, while two bedrooms dropped 0.6% to $1,485. On a year to date basis, one and two bedroom prices are up 2.1% and 2.2%, respectively.

Top Five Rental Markets

1. San Francisco, CA one bedroom rent inched up 0.3% to $3,550, while two bedrooms dropped 0.8% to $4,750.

2. New York, NY continued its downward trend with both one and two bedrooms decreasing 2% to $2,970 and $3,370, respectively.

3. Boston, MA moved up one spot to rank as the 3rd priciest city with one bedroom rent growing 0.4% to $2,510. Two bedrooms remained flat at $2,900.

4. Oakland, CA also bumped up one ranking to become 4th with one bedroom rent climbing 2.5% to $2,480 and two bedrooms jumping 4.9% to $3,000. Notably, on a year over year basis, one bedroom rent is up 14.3%.

5. San Jose, CA dropped 2 spots to round out our top 5 markets. One bedroom rent here fell 2.4% to $2,460, while two bedrooms took a 2% dip to $2,940.

Notable Changes This Month

Upward

–Lincoln, NE one bedroom rent had the largest monthly growth rate, up 5.7% to $740, and shot up 4 spots to rank as the 87th priciest city. Two bedrooms had more modest growth, climbing 2.2% to $950.

–Colorado Springs, CO moved up 6 positions to rank as the 56th most expensive city with one bedroom rent growing 5.5% to $960 and two bedrooms increasing 0.8% to $1,200.

–Columbus, OH one bedroom rent climbed 5.4%, settling at $780, and up 5 spots to become 83rd.

–Memphis, TN was catapulted up 6 rankings to 78th with one bedroom rent growing 5.2% to $810.

–Newark, NJ saw one bedroom rent jump 2 spots to rank as 28th. One bedroom rent increased 5% to $1,270, while two bedrooms grew 3.9% to $1,610.

Downward

–Durham, NC one bedroom rent saw a 6 ranking dip to 51st with the largest monthly decline in the nation, down 5.4% to $1,050. Two bedrooms fell 4.7% to $1,230.

–Minneapolis, MN moved down 1 spot to 24th with one bedroom rent decreasing 5.1% to $1,310 and two bedrooms declining 0.6% to $1,800.

–Shreveport, LA one bedroom rent fell 4.7%, settling at $610, and down 3 positions to rank as the 99th priciest. Two bedroom rent had an even more dramatic decline, decreasing 5.4% to $700.

–Charlotte, NC dropped 5 spots to become the 32nd most expensive city with one bedroom rent falling 4.7% to $1,220 and two bedrooms decreasing 4.9% to $1,360.

–Laredo, TX took a 9 ranking plunge to 76th with one bedroom rent falling 4.6% to $830.

Full Data

| 1 Bedroom | 2 Bedrooms | ||||||

|---|---|---|---|---|---|---|---|

| Pos. | City | Price | M/M % | Y/Y % | Price | M/M % | Y/Y % |

| 1 | San Francisco, CA | $3,550 | 0.30% | -2.70% | $4,750 | -0.80% | -1.00% |

| 2 | New York, NY | $2,970 | -2.00% | 4.20% | $3,370 | -2.00% | 2.70% |

| 3 | Boston, MA | $2,510 | 0.40% | 6.40% | $2,900 | 0.00% | 7.40% |

| 4 | Oakland, CA | $2,480 | 2.50% | 14.30% | $3,000 | 4.90% | 9.10% |

| 5 | San Jose, CA | $2,460 | -2.40% | -0.40% | $2,940 | -2.00% | -2.30% |

| 6 | Washington, DC | $2,300 | 0.40% | 6.50% | $2,790 | -4.10% | 3.00% |

| 7 | Los Angeles, CA | $2,270 | 0.00% | -4.20% | $3,160 | 0.30% | -2.50% |

| 8 | Seattle, WA | $1,890 | 0.50% | -1.00% | $2,390 | -0.80% | -5.50% |

| 9 | San Diego, CA | $1,800 | 2.90% | -2.20% | $2,400 | -2.00% | -4.00% |

| 10 | Anaheim, CA | $1,720 | -1.70% | 0.60% | $2,100 | -1.40% | -0.90% |

| 10 | Miami, FL | $1,720 | -2.30% | -4.40% | $2,280 | -0.90% | -6.20% |

| 12 | Honolulu, HI | $1,650 | 4.40% | -1.80% | $2,110 | -4.10% | -4.10% |

| 13 | Santa Ana, CA | $1,620 | -4.10% | -15.60% | $2,130 | 1.40% | -5.30% |

| 14 | Fort Lauderdale, FL | $1,600 | 0.00% | 6.70% | $2,120 | 1.00% | 6.50% |

| 15 | Denver, CO | $1,580 | -1.30% | 5.30% | $2,000 | 0.00% | 4.70% |

| 16 | Providence, RI | $1,550 | -1.90% | 9.90% | $1,650 | -0.60% | 5.80% |

| 17 | Long Beach, CA | $1,540 | -0.60% | -1.90% | $2,000 | -4.80% | 0.00% |

| 18 | Philadelphia, PA | $1,500 | 3.40% | -3.20% | $1,700 | 0.00% | 0.00% |

| 19 | Chicago, IL | $1,430 | -1.40% | -5.30% | $1,750 | -2.20% | -5.90% |

| 19 | Portland, OR | $1,430 | 2.10% | 2.10% | $1,770 | -0.60% | 6.60% |

| 21 | Atlanta, GA | $1,410 | 0.70% | -3.40% | $1,810 | 1.70% | 0.00% |

| 22 | Scottsdale, AZ | $1,400 | 0.70% | 9.40% | $1,970 | -0.50% | 0.00% |

| 23 | New Orleans, LA | $1,360 | 0.00% | -0.70% | $1,630 | 1.20% | 9.40% |

| 24 | Minneapolis, MN | $1,310 | -5.10% | -9.00% | $1,800 | -0.60% | -9.10% |

| 25 | Sacramento, CA | $1,300 | -0.80% | 1.60% | $1,450 | -2.70% | 2.80% |

| 26 | Nashville, TN | $1,290 | 4.90% | -4.40% | $1,440 | 2.90% | 3.60% |

| 26 | Orlando, FL | $1,290 | -1.50% | 2.40% | $1,410 | -3.40% | -3.40% |

| 28 | Newark, NJ | $1,270 | 5.00% | 7.60% | $1,610 | 3.90% | 14.20% |

| 29 | Austin, TX | $1,250 | 3.30% | 1.60% | $1,570 | 2.60% | 4.70% |

| 29 | Gilbert, AZ | $1,250 | 3.30% | 12.60% | $1,500 | 1.40% | 12.80% |

| 31 | Dallas, TX | $1,240 | 0.00% | -2.40% | $1,700 | -0.60% | -0.60% |

| 32 | Charlotte, NC | $1,220 | -4.70% | 6.10% | $1,360 | -4.90% | 5.40% |

| 33 | Chandler, AZ | $1,210 | 0.80% | 10.00% | $1,420 | -3.40% | 8.40% |

| 34 | Madison, WI | $1,200 | 0.00% | -7.70% | $1,400 | 2.90% | -5.40% |

| 34 | Plano, TX | $1,200 | 0.00% | 5.30% | $1,610 | -3.00% | 6.60% |

| 36 | Baltimore, MD | $1,160 | -1.70% | -15.90% | $1,410 | -4.70% | -14.50% |

| 36 | Pittsburgh, PA | $1,160 | 2.70% | 0.90% | $1,340 | 3.10% | -0.70% |

| 38 | Fort Worth, TX | $1,150 | -2.50% | 7.50% | $1,330 | -2.90% | 3.90% |

| 39 | Irving, TX | $1,140 | 0.90% | 0.00% | $1,430 | -4.70% | 0.70% |

| 40 | Henderson, NV | $1,130 | 0.00% | 5.60% | $1,350 | 0.00% | 7.10% |

| 40 | Tampa, FL | $1,130 | -2.60% | 0.00% | $1,330 | 2.30% | -0.70% |

| 42 | Salt Lake City, UT | $1,100 | -1.80% | 5.80% | $1,370 | -4.90% | -0.70% |

| 42 | St Petersburg, FL | $1,100 | -4.30% | 4.80% | $1,500 | -3.80% | -1.30% |

| 44 | Buffalo, NY | $1,090 | 4.80% | 5.80% | $1,300 | 4.80% | -3.70% |

| 44 | Chesapeake, VA | $1,090 | 4.80% | 4.80% | $1,250 | 0.00% | 4.20% |

| 46 | Aurora, CO | $1,080 | -4.40% | -6.10% | $1,460 | -2.70% | 0.70% |

| 46 | Richmond, VA | $1,080 | 0.90% | 0.90% | $1,290 | 2.40% | 4.90% |

| 48 | Houston, TX | $1,070 | -2.70% | -15.10% | $1,330 | -1.50% | -15.30% |

| 48 | Milwaukee, WI | $1,070 | 4.90% | 10.30% | $1,120 | 4.70% | 0.90% |

| 48 | Virginia Beach, VA | $1,070 | -1.80% | 4.90% | $1,220 | 0.80% | 1.70% |

| 51 | Durham, NC | $1,050 | -5.40% | -7.90% | $1,230 | -4.70% | -1.60% |

| 52 | Raleigh, NC | $1,030 | -2.80% | 3.00% | $1,200 | -4.00% | 3.40% |

| 53 | Phoenix, AZ | $1,010 | 1.00% | 6.30% | $1,250 | -0.80% | 5.00% |

| 54 | Boise, ID | $980 | -3.00% | 6.50% | $1,140 | 4.60% | 10.70% |

| 54 | Reno, NV | $980 | 2.10% | 15.30% | $1,360 | -1.40% | 13.30% |

| 56 | Colorado Springs, CO | $960 | 5.50% | 5.50% | $1,200 | 0.80% | 9.10% |

| 56 | Las Vegas, NV | $960 | -4.00% | 4.30% | $1,200 | -0.80% | 7.10% |

| 58 | Kansas City, MO | $950 | 0.00% | 1.10% | $1,110 | 0.90% | 4.70% |

| 59 | Fresno, CA | $940 | -1.10% | -2.10% | $1,150 | 0.00% | 5.50% |

| 60 | Jacksonville, FL | $930 | 2.20% | -3.10% | $1,030 | -1.90% | -5.50% |

| 61 | Rochester, NY | $920 | 4.50% | 12.20% | $1,080 | 4.90% | 6.90% |

| 62 | Anchorage, AK | $900 | -1.10% | 0.00% | $1,150 | 0.90% | 0.00% |

| 62 | Arlington, TX | $900 | 4.70% | 11.10% | $1,120 | 0.00% | 3.70% |

| 62 | Mesa, AZ | $900 | -2.20% | 4.70% | $1,170 | 0.90% | 14.70% |

| 62 | Syracuse, NY | $900 | -5.30% | 9.80% | $1,030 | -4.60% | 2.00% |

| 66 | Cleveland, OH | $890 | 4.70% | 12.70% | $960 | 5.50% | 10.30% |

| 66 | Corpus Christi, TX | $890 | 4.70% | 2.30% | $1,060 | -0.90% | -0.90% |

| 66 | Glendale, AZ | $890 | 4.70% | 15.60% | $1,060 | 0.00% | 11.60% |

| 66 | Louisville, KY | $890 | -4.30% | 6.00% | $970 | -2.00% | -4.90% |

| 66 | San Antonio, TX | $890 | -1.10% | -3.30% | $1,130 | -0.90% | -1.70% |

| 71 | Norfolk, VA | $880 | 4.80% | 8.60% | $990 | -2.90% | 5.30% |

| 72 | Knoxville, TN | $870 | 4.80% | 7.40% | $990 | 4.20% | 6.50% |

| 72 | St Louis, MO | $870 | 4.80% | 14.50% | $1,140 | -5.00% | 4.60% |

| 74 | Chattanooga, TN | $860 | 4.90% | 10.30% | $980 | 5.40% | 15.30% |

| 74 | Cincinnati, OH | $860 | 4.90% | 10.30% | $1,240 | 5.10% | 9.70% |

| 76 | Laredo, TX | $830 | -4.60% | 0.00% | $920 | 0.00% | -7.10% |

| 76 | Tallahassee, FL | $830 | 3.80% | 13.70% | $900 | -1.10% | 3.40% |

| 78 | Memphis, TN | $810 | 5.20% | 11.00% | $860 | 4.90% | 8.90% |

| 79 | Baton Rouge, LA | $800 | 0.00% | -3.60% | $920 | 0.00% | -3.20% |

| 79 | Omaha, NE | $800 | -1.20% | -3.60% | $1,000 | -2.00% | -8.30% |

| 79 | Spokane, WA | $800 | -1.20% | 12.70% | $1,000 | 2.00% | 11.10% |

| 82 | Winston Salem, NC | $790 | -2.50% | 1.30% | $860 | 1.20% | -2.30% |

| 83 | Augusta, GA | $780 | 0.00% | 4.00% | $850 | 2.40% | 2.40% |

| 83 | Columbus, OH | $780 | 5.40% | 1.30% | $1,080 | -4.40% | 0.90% |

| 85 | Indianapolis, IN | $760 | -1.30% | 15.20% | $890 | 4.70% | 11.30% |

| 86 | Oklahoma City, OK | $750 | 4.20% | 4.20% | $920 | 3.40% | 5.70% |

| 87 | Des Moines, IA | $740 | -5.10% | -10.80% | $870 | 1.20% | -3.30% |

| 87 | Lexington, KY | $740 | -1.30% | -2.60% | $950 | -1.00% | 3.30% |

| 87 | Lincoln, NE | $740 | 5.70% | 5.70% | $950 | 2.20% | -1.00% |

| 90 | Bakersfield, CA | $730 | -3.90% | -2.70% | $910 | 1.10% | 5.80% |

| 90 | Greensboro, NC | $730 | 0.00% | 1.40% | $840 | -1.20% | 1.20% |

| 92 | Albuquerque, NM | $700 | 0.00% | 4.50% | $850 | -4.50% | 1.20% |

| 93 | Tulsa, OK | $680 | 3.00% | 7.90% | $820 | 1.20% | 2.50% |

| 94 | Detroit, MI | $670 | 4.70% | 11.70% | $760 | 5.60% | 8.60% |

| 94 | Tucson, AZ | $670 | 3.10% | 6.30% | $880 | 0.00% | 3.50% |

| 96 | El Paso, TX | $640 | -1.50% | 0.00% | $780 | 1.30% | 4.00% |

| 96 | Wichita, KS | $640 | 1.60% | 4.90% | $760 | 2.70% | 2.70% |

| 98 | Lubbock, TX | $630 | 5.00% | 1.60% | $750 | -5.10% | -2.60% |

| 99 | Shreveport, LA | $610 | -4.70% | -4.70% | $700 | -5.40% | -2.80% |

| 100 | Akron, OH | $590 | 1.70% | 7.30% | $700 | -1.40% | 0.00% |

About

The Zumper National Rent Report analyzes rental data from over 1 million active listings across the United States. Data is aggregated on a monthly basis to calculate median asking rents for the top 100 metro areas by population, providing a comprehensive view of the current state of the market. The report is based on all data available in the month prior to publication.

If you’re interested in a more in-depth explanation of how and why we calculate our rent data, view our methodology post.

To keep up to date with rent changes across the country, like or follow Zumper on Facebook, Twitter, and Instagram. In the market for a new place? Search apartments for renton Zumper.