The rental industry took a hit the last 2 weeks of March. Google search volumes for apartments for rent were down anywhere between 10%-30% in our top cities, Zumper’s long-term inventory was down 12%, and properties stayed on the market 29% longer post-outbreak. However, as we entered into April, the rental market began to show signs of recovery.

Apartment rental demand begins to rebound in April

Comparing data from the last week of March to the first week of April, we’ve seen an increase in demand overall, as Google Search volume grew 10% and Zumper traffic climbed 12%. Zumper’s long-term inventory also grew 6% in the same time frame as well.

The chart below breaks down Google search volumes for apartments for rent in our top 20 cities.

Please note that the chart is interactive and the full data set is downloadable.

First cities to have shelter-in-place or stay-at-home policies have rebounded quickly

The cities that first adopted aggressive shelter-in-place or stay-at-home policies in reaction to the pandemic, like San Francisco, Chicago, and New York City, experienced some of the largest drop-offs for Google search volumes mid to end of March. San Francisco search volumes were down 36% then, Chicago down 25%, and New York City down 29%. However, as we entered into April, these cities were also the first to rebound with Google search volumes growing between 25-40%, respectively, as shown in the chart above. As people begin to think about their moves again ahead of the shelter-in-place or stay-at-home orders being lifted and as we enter into the official start of moving season this spring, the interest in rentals has begun to grow again.

Nationally, people have more free time to browse, want to move to cheaper apartments, and are changing the way they think about online touring

Non-essential workers generally have more free time now as they are not commuting to and from work every day or going out on the weekends, so many are bored and may want to browse apartments in their free time.

People seem to be looking for cheaper places to rent as unemployment rates rise and the economy may enter a recession. In the first week of April, we saw the lowest median rent price messaged for one-bedrooms ever, which was $870. To give some perspective, the national median one-bedroom rent was $1,221 in our most recent National Rent Report.

With the recent influx in the availability of virtual tours, apartment hunting during this time has gotten easier so renter behaviors are evolving. The number of Zumper listings with online tour features has grown 300% since the beginning of the pandemic and listings with online tour features were 8% more likely to be viewed.

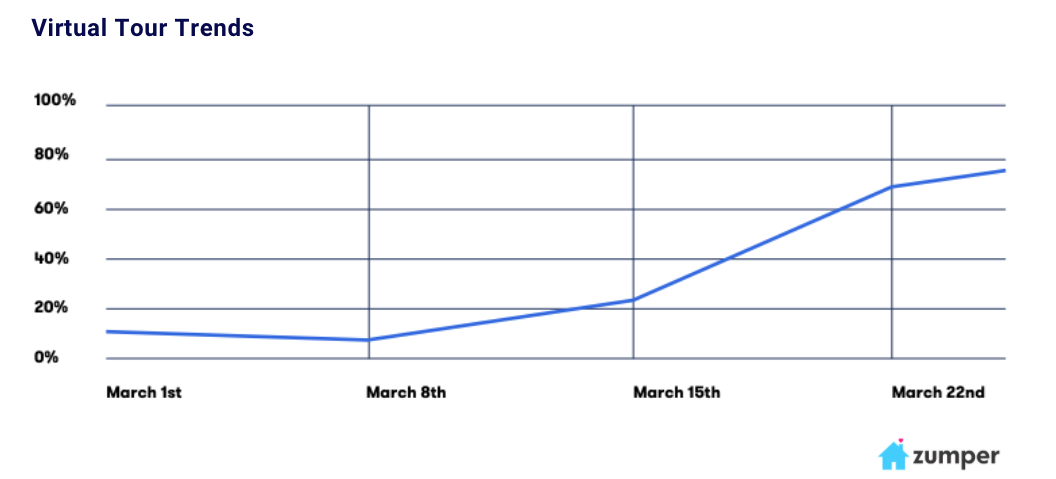

Over the last month, nationwide Google searches for “virtual tours” have increased exponentially. Renters across the country are searching for alternatives to in-person tours.

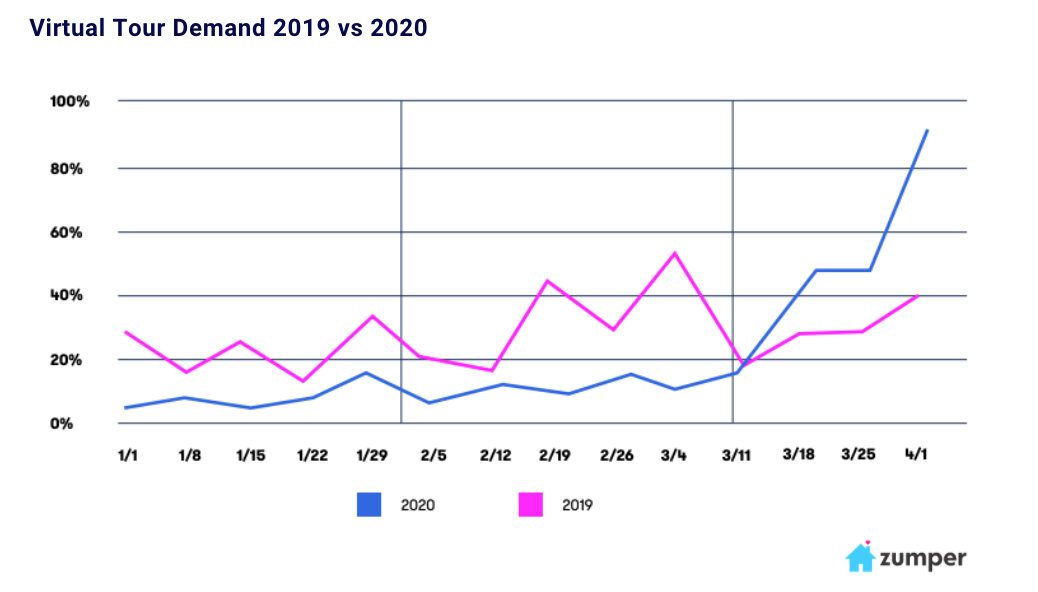

Demand for virtual tours has seen a sharp increase this year compared to last year. Renters and property management are seeking out new ways they can use technology to explore apartments.

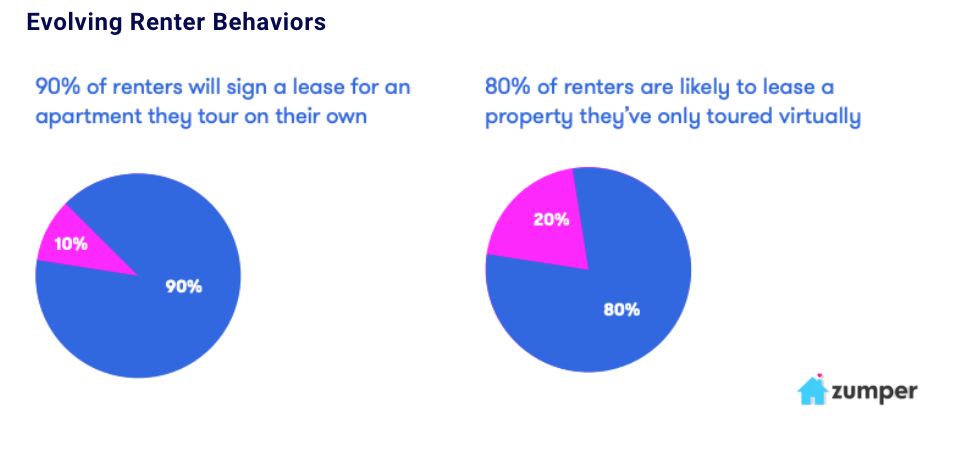

In a recent survey, we asked Zumper renters the likelihood that they would rent an apartment without physically doing an in-person tour. 80% of renters were open to leasing a property that they’ve only toured virtually.

Zumper Traffic Before & After Shelter-in-Place

Please note that the map is interactive and the full data set is downloadable.

Since we have full traffic data for the months of February and March, we thought breaking down the changes in traffic by state would be an interesting way to see the varied effects of COVID-19.

Maryland and Virginia, states that did not have statewide stay-at-home or shelter-in-place orders until March 30th, had the largest monthly traffic growth, climbing 26% and 14%, respectively. Meanwhile, states like California, New York, Washington that had earlier statewide stay-at-home or shelter-in-place orders, between March 19-23rd, all saw traffic drop around 20% in March. The 7-11 days really made a difference.

About

This Zumper update on COVID-19’s effects on the rental market in Q1 2020 is based on inventory, traffic, and rent price data from Zumper.com as well as Google search volumes for “apartments for rent” both at a national level and at a city level.

To keep up to date with rent changes across the country, like or follow Zumper on Facebook, Twitter, and Instagram. In the market for a new place? Search apartments for rent on Zumper.