Record High Rents

As we know, it is expensive to live near the sparking waters of the San Francisco Bay. San Francisco’s rental housing prices are consistently among the highest in the country, fueled by a shortage of available housing units and a growing population of renters. In these respects, the San Francisco Bay Area is similar to other major metropolitan areas such as New York, Boston, and Washington D.C. Unlike other cities, the San Francisco Bay Area is home to the hottest technology job market in the country, where more than a tenth of jobs are within the technology industry. Venture capital is the mighty engine of economic growth that fuels this job market.

Unprecedented Venture Capital Investment

In 2014, the San Francisco Bay Area received $22 billion of investment from the venture capital community. This represents nearly half of all venture capital in the United States, and includes several mega-deals – investments of $100 million or more – for companies such as Uber ($1.2 billion), Cloudera ($740 million), and Airbnb ($475 million). As a result of this significant economic stimulation, September 2015 median 1-bedroom rent has now soared to $3,530 per month.

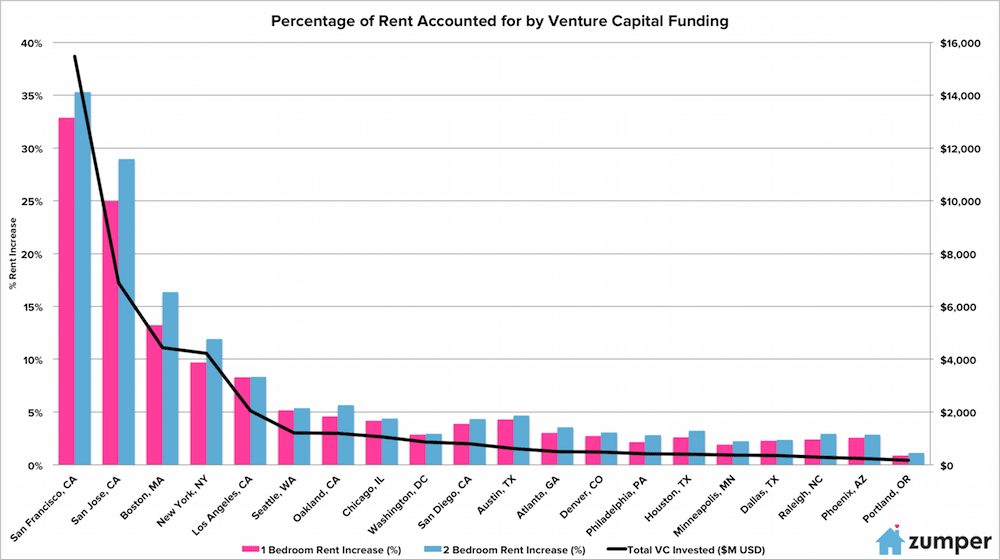

San Francisco is not alone in this venture capital fueled housing crisis. In 2014, venture capitalists invested $48.984 billion across 160 U.S. metropolitan areas, according to the MoneyTree™ Report by PricewaterhouseCoopers LLP (PwC) and the National Venture Capital Association (NVCA), based on data from Thomson Reuters. Although this appears to be a geographically diverse distribution, 78% of this venture capital was deployed to just 10 U.S. cities. It is not a coincidence that these cities also top the list of most expensive rentals in the country.

We can easily see that a high level correlation exists between high rents and venture capital funding. However, this correlation could be due to many factors – overall employment market, influx of millennial renters, or the inherent charisma of these cities. In order to accurately measure this correlation, Zumper has conducted an in-depth study of the impact of venture capital investment while accounting for the effects of other influential factors – population, median household income, median home values, rental housing vacancy rates, and impact of local rent control ordinances. The dataset for average rents is based on over 3 million active listings processed in 2014 on Zumper.

Impact on Rental Market

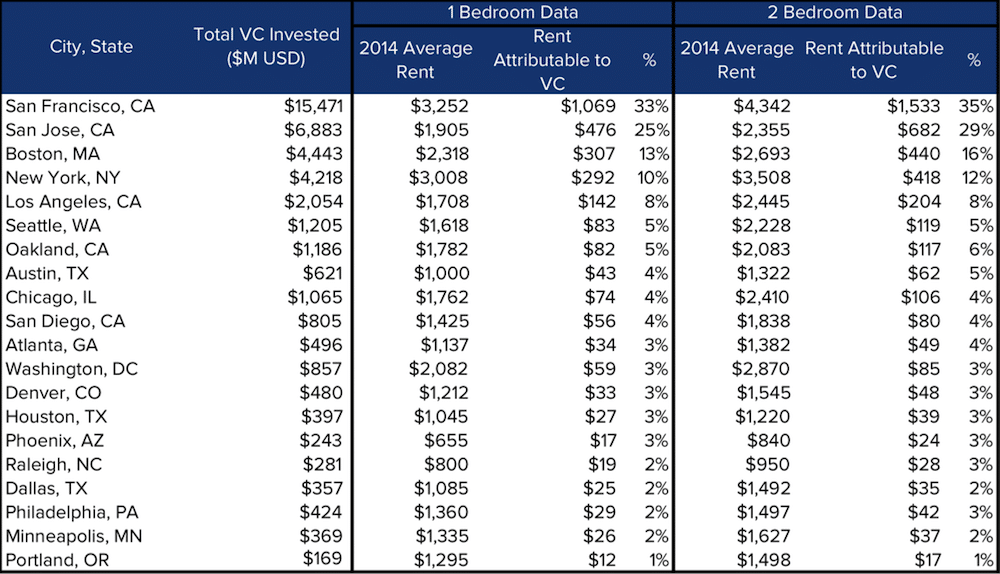

Zumper has found that for every $1 billion in venture capital injected into a local economy, 1-bedroom rents will increase $69 per month, and 2-bedroom rents will increase $99 per month. Although this may not seem significant, we must account for the massive scale of venture capital investment in major technology hubs of San Francisco, San Jose, Boston, and New York. In these metropolitan areas, the influx of capital has raised 1-bedroom rents significantly. At the highest level, $1,069 or 33% of a 1-bedroom in San Francisco can be attributed to economic stimulation from venture capital investment. San Jose takes second place, where 25% of rents can be attributed to investment ($476 monthly), followed by Boston 13% ($307 monthly), and New York, 10% ($292 monthly).

Outlook

Those who hope to make a home in these technology boomtowns should expect rising rents to be commonplace in the near term. Although city governments and multi-family real estate developers are attempting to increase housing supply, their ability to satisfy housing demand will take many years. If venture capital investing remains strong, we can expect a continuation of the migration of start-ups and technology workers toward these metropolitan areas. Further rent increases will be realized as demand for housing and population swells.

For those who already call these boomtowns home, affordable housing options do exist but finding them may take additional research and creativity. A plethora of rental research and listings exists and can assist in finding that perfect (and perhaps affordable) apartment. Check out Zumper Rental Trends to find the most and least affordable neighborhoods in your city.

Appendix: Methodology

Zumper analysts completed multivariable linear regressions on average 1-bedroom and 2-bedroom rental data against venture capital investment dollars and macro-economic factors, including: US Census data (population, median household income, housing vacancy rates, unemployment rates), rent control ordinances, and median home values.

Regression Equation:

Rent_Price = β0 + β1VC + β2Population + β3Median_Income (Census) + β4Rental_Vacancy + β5Rent_Control (Dummy) + β6Median_Home_Value + ε

1-bedroom and 2-bedroom average rental prices were generated from every active listing in 2014 within Zumper’s database, about 3.1 million across the 43 metro regions studied. Zumper gathers data through hundreds of thousands of direct postings through the Zumper Pro platform and partnerships with every major Internet Listing Service in the United States. The Zumper Pro platform provides marketing and tenant screening services for landlords and rental brokers.

Adjusted R-Square for 1-bedroom and 2-bedroom regressions were 0.86 and 0.82, respectively. Results of the regression analysis indicate that the most significant variables influencing rental-housing prices are venture capital investment and total population, followed by rental vacancy rates, median home value, rent control ordinances, and median household income. P-values for the venture capital investment variable were 0.013 for 1-bedroom listings and 0.021 for 2-bedroom listings. Variance inflation factor (VIF) for all variables have been tested below threshold of 0.0002.

Andrew Duboff is a housing economist at Zumper. Andrew is currently a graduate student at the Haas School of Business at the University of California Berkeley, with a focus on real estate and urban economics

This product uses the Census Bureau Data API but is not endorsed or certified by the Census Bureau.