We recently published our 2019 State of The American Renter report, which surveyed more than 10,000 of our users, and this post dives deeper into the perspective of owning a home in general and the shifting mindset of renters in terms of what it means to achieve the American Dream. View the full report here.

Key Findings

- 1 in 3 respondents did not believe that the American Dream involves homeownership.

- 1 in 5 respondents do not want to buy a home ever.

- For respondents who do plan to buy a home in the future, they are not saving much, to any, of their monthly income.

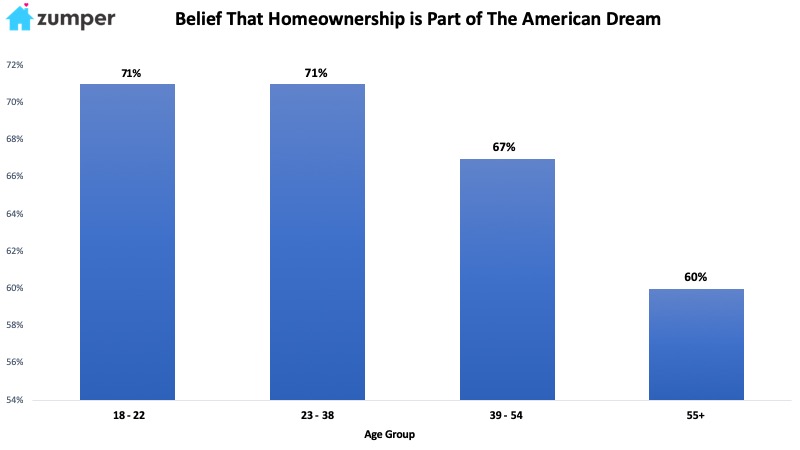

Overall, 32% of respondents said they do not believe that the American Dream involves homeownership, which is in line with the past few years’ reports. Our 2018 survey reported 33%, our 2017 survey reported 32%, and our 2016 survey reported 29%. So, the overall trend signals a continued shift away from owning a home as the American ideal.

Planning

As people age, the general trend is that they believe less and less that owning a home is part of the American Dream. It seems, in general, that they are becoming more realistic about what they want in terms of homeowner responsibilities and paying for things like property taxes and down payments. Another factor may be once an individual or couple gets closer to the empty nest stage, if they had children, then they don’t see the point of owning a larger home and prefer to continue renting for more freedom.

Similarly, as annual income and credit scores rose in our respondents, they were less likely to believe that owning a home was part of the American Dream as well. Instinctively, the assumption would be that people with more opportunity to purchase a home would do so but they seem to reject this idea. Two large factors into this perspective may be people’s desires to 2) free themselves from the responsibility of homeownership and 2) to live a flexible lifestyle (which nearly half of all respondents reported as top reasons as to why they rented instead of owned).

While 30% of respondents this year said they planned to buy a home in the next 2 years, 44% of respondents in the 2018 report said the same, which is a huge difference of 14 percentage points. The number of people who never plan on purchasing a home also increased from 21% in 2018 to 22% in 2019. This signals a shift away from the sentiment that people want to own homes as quickly as they can.

Finances

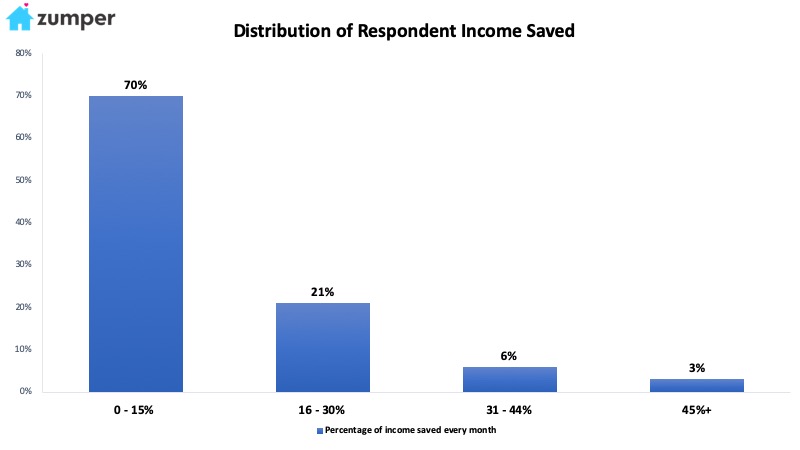

Though 61% of respondents reported that they were planning to buy a home in the next 5 years, a majority of them reported saving between 0-15% of their income every month. Keeping in mind that the median annual income from this survey was between $25,000 – $49,999, it would be difficult to afford a home in large cities, which was where a majority of our respondents lived when taking this survey. In addition, the overall number of respondents who had student loans increased from 38% in 2018 to 45% in 2019. With minimal savings and nearly half of all respondents’ incomes potentially going toward student loans, it seems unrealistic that the goal of owning a home in the foreseeable future could be met.

About Us

Zumper is a small and wildly ambitious startup tackling a problem that affects over 100 million renters across the US and Canada. We believe that renters shouldn’t engage with technology only to search for their next home or apartment rental.

To keep up to date with rent changes across the country, like or follow Zumper on Facebook, Twitter, and Instagram. In the market for a new place? Search apartments for rent on Zumper.